Last Updated on July 17, 2024 by Nadeem Ahmed

In the fast-paced world of personal finance, credit cards have become more than just convenient payment tools – they’re gateways to a realm of tantalizing rewards. Among the numerous options available, Visa credit cards stand out as versatile companions, offering a diverse array of perks tailored to suit every lifestyle.

Whether you’re a globetrotter seeking travel miles, a savvy shopper craving cash back, or an aficionado of rewards points, Visa offers something for everyone.

Table of Contents

The Three Pillars of Visa Rewards

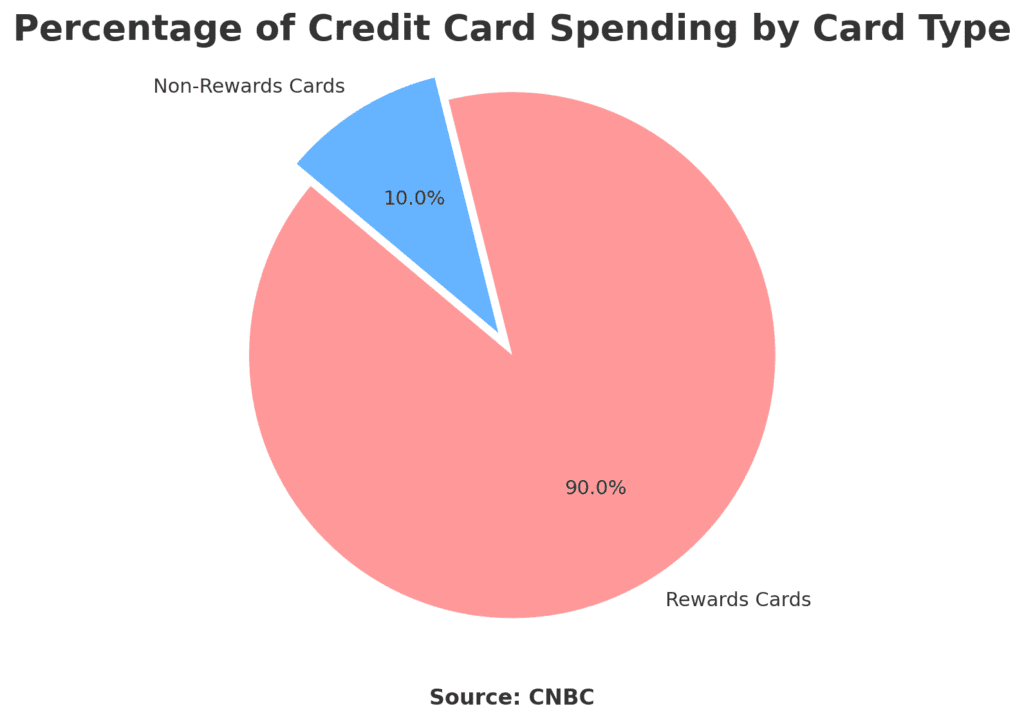

Visa has long been at the forefront of the rewards credit card revolution, offering a diverse array of options to cater to every lifestyle and spending habit. To provide a better understanding, we’ve put together a handy chart:

The ability to earn valuable rewards with every purchase has made these cards incredibly popular. To help you understand the key offerings, let’s explore the three main pillars of Visa’s rewards ecosystem.

1. Cash Back: The Evergreen Allure

Cash back credit cards are the quintessential crowd-pleasers, appealing to spenders across the spectrum. With every swipe of your card, you earn a percentage of your purchase back in cold, hard cash. Some cards offer a flat rate on all purchases, while others ramp up the rewards with boosted cash back percentages for specific spending categories like dining, groceries, or gas.

2. Travel Miles: Fuel for the Wanderlust

For those with a chronic case of wanderlust, travel credit cards are the ultimate enablers. With every purchase, you accumulate travel miles that can be redeemed for flights, hotel stays, and other travel-related expenses. Some cards are co-branded with specific airlines, while others offer more flexibility in choosing your travel partners.

3. Rewards Points: The Swiss Army Knife of Perks

Rounding out the trifecta are rewards points, the versatile Swiss Army knives of the credit card world. These points accrue with every swipe, and can be redeemed for a smorgasbord of options, from statement credits and merchandise to travel bookings and even charitable donations. Some banks even allow you to apply points towards paying down your mortgage or other loans.

Whether you’re a cash-back connoisseur, a travel enthusiast, or a points aficionado, Visa has something to offer. For instance, let’s say you’re in Boise, Idaho, and looking for a rewards visa credit card boise id that aligns with your spending habits. With Visa’s diverse range of rewards programs, you’re sure to find a card that caters to your needs and helps you maximize your earnings with every purchase.

Find Your Perfect Match: Top Visa Cards for Every Lifestyle

With a vast selection of Visa credit cards, finding the one that aligns with your spending habits and goals is crucial. Here are a few standout options to consider:

For Amazon Aficionados: Prime Visa

- Cash Back: Up to 5% on Amazon.com, Amazon Fresh, Whole Foods Market, and Chase Travel purchases

- Welcome Bonus: $100 Amazon Gift Card

- Credit Score: Good to Excellent (700-749)

For Flat-Rate Cash Back Lovers: Chase Freedom Unlimited®

- Cash Back: Up to 6.5% reward rate (additional 1.5% on up to $20,000 spent in the first year)

- Welcome Bonus: Up to $300 cash back

- Credit Score: Excellent to Good (700-749)

For Mid-Range Travel Rewards: Chase Sapphire Preferred® Card

- Travel Rewards: 5x on travel through Chase Ultimate Rewards®, 3x on dining, select streaming services, and online groceries

- Welcome Bonus: 60,000 bonus points

- Annual Fee: $95

For Premium Travel Perks: Capital One Venture X Rewards Credit Card

- Travel Rewards: 2 miles per dollar on eligible purchases, 5 miles per dollar on flights

- Welcome Bonus: Earn 75,000 bonus miles

- Annual Fee: $395

To help you compare these cards side-by-side, here’s a handy table:

| Card | Cash Back/Travel Rewards | Welcome Bonus | Annual Fee | Credit Score |

| Prime Visa | Up to 5% cash back on select purchases | $100 Amazon Gift Card | $0 | 700-749 |

| Chase Freedom Unlimited® | Up to 6.5% cash back | Up to $300 cash back | $0 | 700-749 |

| Chase Sapphire Preferred® | 5x travel, 3x dining/streaming/groceries | 60,000 bonus points | $95 | 700-749 |

| Capital One Venture X | 2x miles on purchases, 5x on flights | 75,000 bonus miles | $395 | Excellent |

Navigating the Rewards Landscape

Maximizing your rewards requires a deep understanding of how these programs work. Let’s explore two crucial aspects:

Tiered Rewards Structures:

Cash Back Tiers: Many Visa cards offer varying cash back percentages based on spending categories. For instance, you might earn 3% back on dining, 2% on groceries, and 1% on everything else. By strategically using your card for purchases in the higher-tier categories, you can significantly boost your cash back earnings.

According to CNBC, “Some Visa cards offer varying cash back percentages based on spending categories, allowing cardholders to earn more rewards by strategically using these tiers.”

Travel Mile Multipliers: For travel enthusiasts, earning extra miles during promotional periods or on specific travel bookings can be a game-changer. Leading financial institutions are investing heavily in travel-related reward programs, emphasizing the importance of these multipliers.

The Redemption Game

Strategic Redemption: The art of timing your reward redemption can make a world of difference. During the pandemic, financial institutions focused on engaging consumers with more flexible redemption options, such as local benefits, food delivery incentives, and media streaming services.Savvy cardholders should keep an eye out for these opportunities to maximize their rewards.

Hidden Gems: Beyond flights and merchandise, many rewards programs offer lesser-known redemption options like gift cards, experiences, and even charitable donations. According to Forbes Advisor, “Alternative redemption options beyond flights and merchandise include receiving cash back, points transferring, offering gift cards, and even offsetting points against everyday spend items.”

Visa vs. Co-Branded Cards

While Visa is a powerhouse, it isn’t the only player in the credit card rewards game. Let’s compare Visa cards with co-branded options:

The Visa Advantage

Universal Acceptance: One of Visa’s most significant advantages is its global reach, ensuring acceptance almost everywhere. As noted by Visa, “Visa’s global reach ensures acceptance almost everywhere, providing cardholders with unparalleled convenience across a wide range of merchants globally.” But do these perks trump the benefits of co-branded cards?

Co-Branded Bonuses

Airline and Hotel Partnerships: Co-branded cards tied to specific airlines or hotel chains offer specialized bonuses that cater to frequent travelers seeking enhanced rewards and benefits. For instance, you might earn bonus miles on airfare or hotel stays with that particular brand. These specialized cards can be worth it for those who consistently use the same travel partners.

The Fine Print

Before diving headfirst into the world of rewards, it’s crucial to understand the fine print:

Expiration Dates

Use It or Lose It: Some rewards programs have expiration dates for unused points or miles. As Bankrate highlights, “Some rewards have expiration dates, highlighting the importance of understanding how to prevent points from expiring and maximizing their value before they vanish.” Staying on top of these deadlines is key to avoiding the disappointment of seeing your hard-earned rewards disappear.

Annual Fees

Cost of Rewards: While many Visa cards have no annual fee, others charge a yearly cost. Analyzing whether the annual fee justifies the rewards earned is crucial for cardholders to ensure they are making a smart investment in their credit card choice. Always weigh the potential rewards against the fees to determine if a particular card is worth the investment.

Maximize Your Rewards: Expert Tips and Tricks

Now that you’ve got a handle on the different types of Visa rewards and some top card options, it’s time to level up your game with expert tips and tricks:

- Bonus Category Mastery: Many cards offer rotating bonus categories that change quarterly. Stay on top of these cycles and adjust your spending accordingly to earn maximum rewards.

- Authorized User Advantage: Adding an authorized user to your account can not only help share the benefits but may also unlock additional perks or bonuses.

- Strategic Redemption: Timing is everything. Strategically redeem your rewards during promotional periods or when redemption values are highest.

- Loyalty Pays Off: Sticking with a particular card issuer or rewards program can often lead to elevated status, exclusive offers, and enhanced redemption options.

The Rewards Journey Awaits

Visa credit cards are more than just payment methods – they’re gateways to a world of enticing rewards, from cash back and travel miles to versatile points programs. By understanding the different types of rewards, choosing the right card for your needs, and implementing expert strategies, you can unlock a wealth of perks and savings.

So, what are you waiting for? Embark on your rewards journey today and start reaping the benefits of your everyday spending. Whether you’re a globetrotter, a savvy shopper, or a points aficionado, the perfect Visa card is out there, ready to elevate your financial experience.

FAQs: Your Rewards Questions Answered

Opt for cards with higher cash-back percentages in categories where you tend to spend the most, like dining, groceries, or gas. Also, keep an eye out for rotating bonus categories and adjust your spending accordingly.

This depends on the type of travel card you have. Non-branded travel rewards cards typically offer more flexibility in redeeming miles across different airlines and hotels. Airline-branded cards, however, may restrict you to redeeming miles solely with that particular carrier.

While points offer versatility, it’s important to read the fine print. Some programs have restrictions on redemption options or expiration dates for unused points. Choose a program that aligns with your lifestyle and spending habits.

Many solid rewards cards have no annual fee, so shop around carefully. If you do opt for a card with an annual fee, make sure the rewards and benefits outweigh the cost.