Last Updated on February 8, 2026 by maryamnawaz

Table of Contents

Introduction

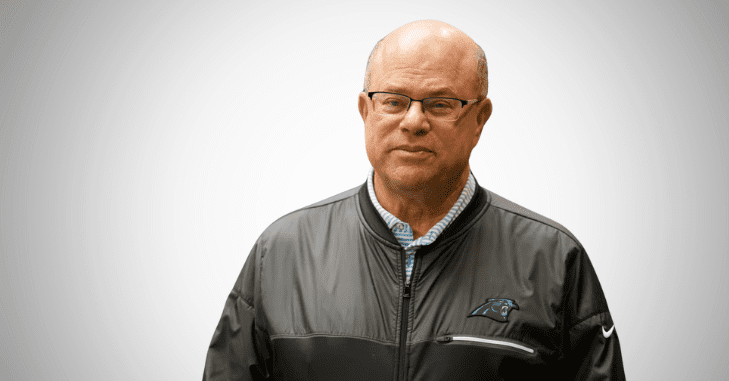

David Tepper’s net worth, estimated at $21.3 billion, ranks him among the wealthiest individuals globally. Born on September 11, 1957, he built his fortune through Appaloosa Management, the hedge fund he founded in 1993. His ability to identify undervalued assets and make bold investments, especially during economic downturns like the 2008 financial crisis, earned him billions.

In 2018, he expanded his influence by purchasing the Carolina Panthers and later founded Charlotte FC, showcasing his interest in professional sports ownership. Beyond finance, Tepper is a dedicated philanthropist, contributing millions to education, disaster relief, and community development.

His donations to Carnegie Mellon University, where the business school now bears his name, highlight his commitment to giving back. David Tepper’s net worth reflects his dominance in finance, strategic investments, and dedication to making a lasting impact through sports and philanthropy.

| Category | Details |

| Full Name | David Alan Tepper |

| Born | September 11, 1957 (66 years old) |

| Birthplace | Pittsburgh, Pennsylvania, USA |

| Education | University of Pittsburgh (B.A.), Carnegie Mellon (MBA) |

| Profession | Investor, Hedge Fund Manager, Sports Owner |

| David Tepper’s Net Worth | $21.3 billion |

| Key Ventures | Appaloosa Management, Carolina Panthers, Charlotte FC |

| Philanthropy | Major donations to education, poverty relief, disaster aid |

| Family | Married to Nicole Bronish, three children |

| Residence | Palm Beach, Florida |

David Tepper’s Net Worth

David Tepper’s net worth is estimated at $21.3 billion, placing him among the richest individuals globally. His fortune primarily stems from his success as the founder of Appaloosa Management, one of history’s most successful hedge funds. Over the years, Tepper’s keen ability to identify undervalued assets and make high-stakes investments during market downturns has earned him billions.

Key Milestones in Building His Wealth

- 2008 Financial Crisis: Tepper made bold bets on recovering financial institutions like Bank of America and Citigroup, earning billions in profits.

- Appaloosa Management: At its peak, the hedge fund managed over $20 billion in assets under management (AUM).

- Transition to Family Office: In 2019, Tepper shifted Appaloosa into a family office model, focusing on managing his wealth rather than external capital.

Tepper’s ability to calculate risks during economic downturns and capitalize on distressed assets has been the cornerstone of his financial success.

Investment Philosophy and Risk-Taking Strategy

David Tepper’s success is deeply rooted in a disciplined yet bold investment philosophy that emphasizes calculated risk-taking during periods of market distress. Unlike conventional investors who avoid uncertainty, Tepper has historically leaned into volatility, viewing economic downturns as opportunities rather than threats.

His approach combines deep fundamental analysis with patience, allowing him to hold positions until markets recover. This long-term mindset, paired with a willingness to make contrarian bets when sentiment is negative, has distinguished him from peers and cemented his reputation as one of the most formidable investors of his generation.

Early Life

David Alan Tepper was born in Pittsburgh, Pennsylvania, on September 11, 1957. He was the second of three children in a working-class Jewish family. His father was an accountant, and his mother was an elementary school teacher.

From an early age, Tepper displayed an aptitude for numbers and analysis, often memorizing baseball statistics—a skill hinting at his future finance career.

Education

Tepper attended Peabody High School before enrolling at the University of Pittsburgh. To fund his education, he worked at the Frick Fine Arts Library on campus. In 1978, he graduated with honors in economics. He later pursued an MBA at Carnegie Mellon University’s business school (now named the Tepper School of Business), graduating in 1982.

Career: Building a Financial Empire

Early Career

Tepper began his career as a credit analyst at Equibank before moving to Republic Steel’s treasury department. These early roles provided him with foundational knowledge about financial markets but left him yearning for more dynamic opportunities.

His big break came when he joined Goldman Sachs in 1985 as part of its high-yield trading group. At Goldman Sachs, Tepper became known for his expertise in distressed debt trading—a niche area involving investments in struggling companies.

Despite his success at Goldman Sachs, Tepper was twice passed over for partnership, which motivated him to start his firm.

Founding Appaloosa Management

In 1993, Tepper founded Appaloosa Management with $57 million in seed capital. The hedge fund quickly gained a reputation for delivering exceptional returns by investing heavily during periods of market turmoil. Some of his most notable successes include:

- 1998 Russian Financial Crisis: Appaloosa profited from undervalued assets during this global downturn.

- 2008 Financial Crisis: His bold investments in financial institutions like Bank of America and Citigroup generated billions in profits for Appaloosa.

By transitioning Appaloosa into a family office in 2019, Tepper signaled a shift toward managing his wealth, focusing on long-term legacy rather than aggressive growth.

Sports Ownership: Expanding His Influence

Carolina Panthers Acquisition

In 2018, David Tepper purchased the NFL’s Carolina Panthers for $2.3 billion, setting a record price for an NFL team. This acquisition marked his entry into professional sports ownership and showcased his willingness to diversify beyond finance. Under his ownership:

- The team underwent significant changes both on and off the field.

- Investments were made in infrastructure improvements such as stadium renovations.

- Community engagement initiatives were launched to strengthen ties with fans.

However, despite these efforts, the Panthers have struggled to achieve consistent success on the field since Tepper’s takeover.

Launching Charlotte FC

In addition to owning the Panthers, Tepper expanded into Major League Soccer (MLS) by launching Charlotte FC in 2019. The team debuted in 2022 but faced challenges common to new franchises, including coaching changes and inconsistent performance.

Critics have pointed out that Tepper’s hands-on management style—characterized by frequent firings—may hinder long-term stability for both teams. However, his investments reflect a broader vision of transforming Charlotte into a hub for professional sports.

Philanthropy: Giving Back to Society

Tepper has consistently demonstrated a commitment to philanthropy throughout his career. One of his most notable contributions came in 2013 when he donated $67 million to Carnegie Mellon University—one of the largest gifts ever made—leading to the renaming of its business school, the Tepper School of Business.

His philanthropic efforts extend beyond education reform. During the COVID-19 pandemic, Tepper donated millions through the David A. Tepper Foundation to support relief efforts in Charlotte and surrounding areas. He has partnered with nonprofits to combat food insecurity and poverty through initiatives like Hunger Hub.

Focus Areas of Philanthropy

- Education: Supporting institutions like Carnegie Mellon University and public schools across Pittsburgh and Charlotte.

- Community Development: Funding programs aimed at alleviating poverty and addressing food insecurity.

- Crisis Relief: Contributing significant resources during emergencies such as hurricanes and pandemics.

Tepper’s approach to giving reflects his belief in addressing systemic issues through education reform and community development, a philosophy rooted in his experiences growing up in Pittsburgh.

Family Life

David Tepper married Nicole Bronish in 2016 after divorcing his first wife. They have three children and reside primarily in Palm Beach, Florida. Known for being private about his personal life, Tepper maintains strong ties to Pittsburgh despite relocating for tax benefits and lifestyle preferences.

Since childhood, Tepper has been an avid sports fan. His passion for athletics extends beyond his ownership roles; he often attends games and engages with fans.

Legacy: A Multifaceted Impact

David Tepper’s legacy spans finance, philanthropy, and sports ownership, reflecting different facets of his personality and vision. He revolutionized distressed debt investing in finance by demonstrating that calculated risks during market downturns can yield outsized rewards.

His transition from managing external capital to focusing on personal wealth underscores a shift toward building a long-term legacy. As a philanthropist, Tepper has directed billions toward education reform, poverty alleviation, and disaster relief efforts, leaving an indelible mark on institutions like Carnegie Mellon University while addressing pressing social issues such as food insecurity through Hunger Hub.

While sports ownership has had mixed results, Tepper’s investments signal a long-term vision to transform Charlotte into a hub for professional athletics.

Conclusion

David Tepper’s extraordinary journey from Pittsburgh’s working-class neighborhoods to becoming one of the world’s wealthiest individuals is remarkable. With a net worth exceeding $21 billion, he continues to wield influence across multiple domains, from reshaping financial markets to redefining what it means to be a modern sports owner.

Through strategic risk-taking, bold investments, and unwavering commitment to philanthropy, David Tepper has built a legacy that transcends wealth—a legacy rooted in innovation, resilience, and giving back to society.

Whether through his financial acumen or contributions to education and community development, Tepper remains an enduring figure whose impact will be felt for generations.

Apart from that if you want to know about “Ashley Biles-Thomas Height: Exploring Her Age” then please visit our “Entertainment” Category.

FAQs

Tepper made his fortune by investing in distressed debt and undervalued assets through Appaloosa Management, which he founded in 1993.

David Tepper owns the Carolina Panthers in the NFL and Charlotte FC in Major League Soccer (MLS). He purchased the Panthers in 2018 for $2.3 billion and paid $325 million in expansion fees to establish Charlotte FC, which began play in 2022.

Where did David Tepper go to college?

Tepper earned a bachelor’s degree in economics from the University of Pittsburgh in 1978 and an MBA from Carnegie Mellon University in 1982.

Why did David Tepper leave Goldman Sachs?

Tepper left Goldman Sachs in 1992 after being twice passed over for a partnership position. This decision motivated him to establish Appaloosa Management, which became one of the most successful hedge funds globally.