Last Updated on February 22, 2024 by Nasir Hanif

Retirement can present several financial challenges for individuals in India. These challenges can affect the standard of living and create persistent financial inconsistencies throughout life. Therefore, it is important to consider the different retirement challenges and make the necessary financial decisions, such as investing in the best retirement plans to ensure you live peacefully.

Let us start by understanding the challenges and figuring out ways to overcome them based on retirement investment.

Table of Contents

Financial Challenges of Retirement

Some of the common retirement planning challenges faced by people in India are as follows:

- Lack of savings to fight inflation – One major challenge is the need for more savings. Many individuals in India need access to formal savings or retirement plans, and those who do may not have saved enough retirement money to last throughout their retirement, considering the inflation rate.

Inflation can erode the purchasing power of their savings over time. It is the rate at which the general level of prices for goods and services is rising, and in India, it has historically been high. Therefore, individuals must evaluate the required funds using the pension calculator to determine the right retirement investment options.

- Rising healthcare costs – Another financial challenge for retired individuals in India is the high cost of healthcare. It can lead to retired individuals using up their savings to pay for medical expenses, leaving them with insufficient retirement funds for other expenses.

- Longevity risk – Longevity risk is also a concern for retired individuals in India. As people live longer and pension funds are inadequate, they may outlive their savings, leaving them without a steady income during retirement. Therefore, consider these factors based on your family’s medical history and lifestyle to determine the best retirement plans in India.

Overcoming The Financial Challenges

Insurance providers in India offer a variety of retirement plans and annuity plans that can help individuals overcome the financial challenges associated with retirement.

- Retirement Plans – Retirement plans offered by insurance providers, such as the Guaranteed Return Insurance Plans, provide life insurance with savings benefits for retirement. As the returns are guaranteed, the policyholders can evaluate the retirement funds for the future based on their age, lifestyle, routine expenses, etc., considering the inflation rate. Further, they can choose the sum assured, savings benefit, policy tenure and premium based on affordability.

These retirement plans are highly flexible. For example, Tata AIA Policy provides the option to pay the premium regularly throughout the policy tenure or for a limited term. In addition, the policyholders can choose to receive the payout as a lump sum, regular income or as a combination of lump sum and regular income.

- Annuity Plans – Annuity plans offered by insurance providers can provide a steady income during retirement, helping to ensure that policyholders have a reliable source of income to pay for their expenses. An Immediate annuity plan can be a good option for those nearing retirement as they provide pension income that starts immediately after purchase.

Furthermore, a deferred annuity plan, which allows individuals to accumulate savings over time and then receive a pension income during their retirement, can be a good option for those who have the time to save retirement money.

The policyholders must research the different retirement solutions available, compare the features and costs and choose the best option to suit their financial needs. In addition, it is important to start investing in a retirement plan early in life to accumulate the maximum returns at an affordable rate during the long term.

Evaluating Retirement Plans: A Crucial Step in Financial Planning

Retirement can present several financial challenges for individuals in India, necessitating a comprehensive approach to financial planning. One of the pivotal aspects is the evaluation of retirement plans. Understanding the nuances of different retirement investment options is crucial for ensuring financial stability during the post-retirement years.

Financial Challenges of Retirement

Some of the common retirement planning challenges faced by people in India include a lack of savings to combat inflation, rising healthcare costs, and longevity risk. Inflation can significantly erode the purchasing power of savings over time, necessitating a robust strategy to counter its effects. Moreover, the escalating expenses associated with healthcare can deplete retirement funds rapidly, leaving individuals financially vulnerable. Longevity risk adds another layer of complexity, as individuals may outlive their savings, leading to financial instability during retirement.

Overcoming The Financial Challenges

To address these challenges effectively, insurance providers in India offer a range of retirement plans and annuity options. Retirement plans, such as Guaranteed Return Insurance Plans, provide a combination of life insurance and savings benefits tailored to retirement needs. These plans offer flexibility in terms of premium payment options and payout structures, empowering individuals to customize their retirement strategy based on their financial circumstances.

Annuity plans serve as another valuable tool in retirement planning, offering a reliable source of income during retirement. Immediate annuity plans provide pension income starting immediately after purchase, catering to individuals nearing retirement age. On the other hand, deferred annuity plans allow for the accumulation of savings over time, ensuring a steady stream of income during retirement years.

Conclusion

Evaluating retirement plans is essential for navigating the financial complexities of retirement in India. By leveraging the diverse range of retirement solutions offered by insurance providers, individuals can mitigate the impact of inflation, rising healthcare costs, and longevity risk. Proactive planning, informed decision-making, and early investment in retirement plans are key to achieving financial security and peace of mind during retirement.

Retirement in India presents several financial challenges, such as a lack of savings, high healthcare costs, longevity risk and inflation. Retirement and annuity plans offered by insurance providers in India can help overcome these challenges by providing an opportunity for regular savings, a steady stream of income and a guarantee of long-term care coverage.

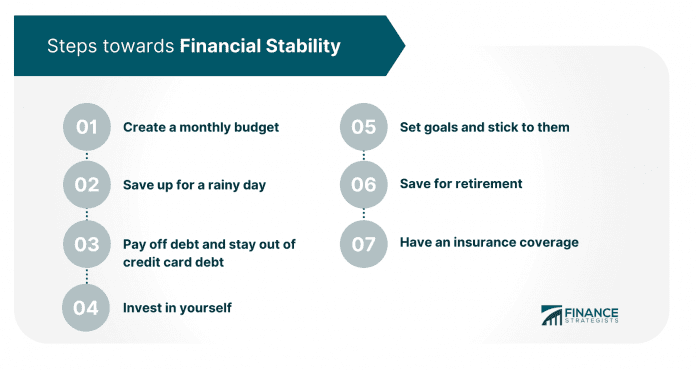

It is important to research and compare retirement solutions to understand the best options available and how to tailor them to your individual needs. Individuals can increase their chances of having a financially secure retirement by proactively planning, budgeting and investing wisely.

Apart from this, if you are interested to know more about Ultimate Guide to Expense Reports then visit our Business category