Last Updated on May 30, 2023 by

UPL, or United Phosphorus Limited, is involved in producing and marketing chemicals for use in industry and agriculture.The company claims to make single food sustainable and handle common agricultural issues while providing farmer advising, training, and spraying services. With customers in more than 130 countries, United Phosphorus Limited is a leading provider of crop protection products on a global scale.

Also, the company has diversified into one of the biggest producers of harmful gas detection devices, Chemo Electronic Laboratory and Enviro Technology, a typical effluent treatment plant.ArystaLifeScience, a leading global provider of crop protection technologies, was purchased by UBL via a subsidiary. The business borrowed a USD 3 billion debt from a syndicate to pay for this.

They made SWAL Corporation Limited, a company that deals in agrochemicals and fertilizer blends, their first-ever acquisition in the Indian market. They also purchased Advanta, a Dutch supplier of seeds and seed technologies. The UPL share price at the time of writing the article is Rs. 717.05, and its market capitalisation stands at Rs. 53,818.59 crore. UPL announced its Q1FY23 results, highlights of which are as follows:

- Strong growth of 27% YoY was seen in Q1 FY23 revenue, reaching Rs. 10,821 crore. This growth was driven by more significant product realizations (18%), a favourable exchange rate (3%), and higher volumes (6%).

- EBITDA increased by 26% YoY in Q1 FY23 to Rs. 2,342 crore from Rs. 1,862 crore in Q1 FY22. Despite inflationary challenges, a significant increase in realisations supported by effective supply chain management helped to preserve EBITDA margins.

Table of Contents

Some positive aspects of the UPL stock are as follows:

- The company has been utilising capital profitably, which has led to improvement in RoCE in the last two years.

- UPL has utilised shareholders’ funds wisely and improved its equity return in the past two years.

- The company also has high trailing 12-month EPS growth.

- Decrease in Provision in recent results

- The organization has a current TTM PE Ratio of less than three, five, and 10 years.

Even though the company shows positive signs, however, its weaknesses cannot be overlooked:

- Insufficient cash flow from core operations has led to declining cash flow from operations during the past two years.

- The company has encountered a falling profit margin and declining net profit (QoQ).

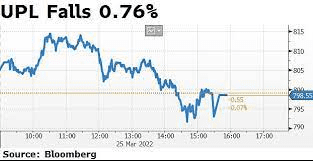

- UPL has high volume, top losers.

Conclusion

Investing in a particular stock depends on many factors. Investing in UPL share price can be risky currently. The analyst suggests selling the stock as of now.However, it is not apparent that the stock will perform similarly in the future. But it is to be seen and analysed before contemplating buying the stock.

Apart from that if you want to know about Invest in Alternative Investments then please visit our Business category.