Last Updated on March 3, 2023 by

DLF or Delhi Land and Finance, is a real estate developer that builds residential, office and retail properties with a market capitalization of Rs. 62,501.62 crore. The company declared its Q4 FY’22 results wherein it reported its revenue at Rs.6138 crore and Net Profit at Rs.1,513 crore with 38% YoY growth.

The DLF share price have been falling due to the following reasons:

- DLF has been facing declining revenue every quarter for the past two quarters.

- It has not generated enough cash flows, as seen in its financial statement.

- The recent legal troubles have been a matter of concern for DLF. These regulatory investigations affect an investor’s mindset, and it takes a lot of effort from the company’s end to instil that confidence.

- EBITDA, which is used to measure the company’s profitability, stood at Rs.472 crores, reflecting a decline of 23% YoY. It is due to the lower other income than the corresponding period.

- Net profit also shows a decline of 8% YoY to Rs.414 crore.

Despite these factors, the company has effectively used its capital to generate a return on capital employed (ROCE) in the last two years. Additionally, there has been an effective use of the shareholder’s funds, and it can manage its assets efficiently to generate profit.

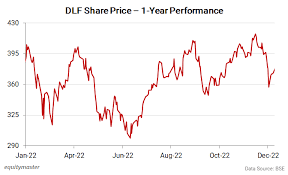

At the time of writing the article, the DLF share pricewas Rs. 356.70. DLF stock has shown outperformance during the market volatility that was recently seen. Stock daily returns range from -2% to 3%. Since the positive counts are higher than the negative point despite the volatility is a good sign. At the time of writing the article, the DLF share pricewas Rs. 356.70. DLF stock has shown outperformance during the market volatility that was recently seen. Stock daily returns range from -2% to 3%. Since the positive counts are higher than the negative point despite the volatility is a good sign.

No major delivery activity was seen despite the profit booking in April-May 2022, which is again a positive sign.

Conclusion

No matter the negative figures of DLF and DLF share price, the investor can still go in to buy the share.It will also help diversify the portfolio as it can be a good stock for long-term purposes.

Apart from that, if you are interested to know about TOP REAL ESTATE ENTREPRENEURS then visit our Business category.